Have been abit too active, but in summary I have cashed out of WynnM and GoldW and AAC and have bought Gazprom and Jardine C&C.

Had a big loss on Food Empire... Wasn't attentive enough

3 Gazprom

4 Jardine CC

5 VICOM

6 Valuetronics

7 Sunningdale

8 ZAGRO

9 LKH

10 Lantrovision

11 Spindex

12 Boustead

YTD up 5%

Gazprom: This Oil And Gas Large-Cap Could Yield 10% By 2016

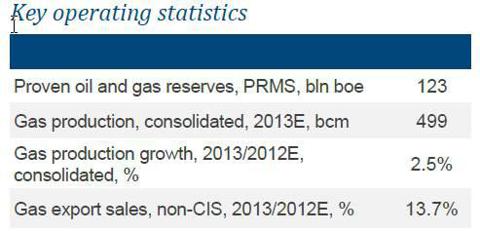

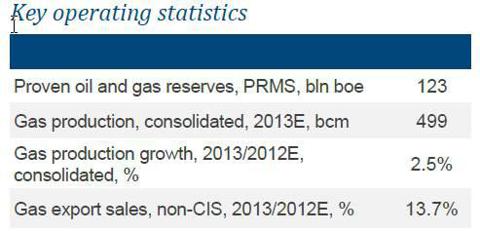

The cheapest large-cap oil and gas company in the world is trading at a 2014 P/E of 3.2 and EV/EBITDA of 2.4, implying 64% and 46% discounts to emerging markets peers. The company trades at a 2015E P/E and EV/EBITDA of 3.0 and 2.2 respectively; a 34% discount to its three-year historic average EV/EBITDA multiple and 19% discount to the three-year average P/E multiple.

Compared to O&G peers on its domestic market, this company trades at a 40% discount on 2015E EV/EBITDA and a 47% discount on 2015E P/E. Compared to international oil majors, this large-cap trades at a 39% discount on 2015E EV/EBITDA, and 2015E P/E shows a 70% discount.

Relative to emerging market peers, this company trades at an average discount on 2015E EV/EBITDA of 44%, and discount on 2015E P/E of 63%. Perhaps its closest EM peer is PetroChina (PTR). Relative to PetroChina, the listed arm of CNPC, we see a 70% discount on 2015E P/E and a 50% discount on 2015E EV/EBITDA.

This large-cap and other DM peers do typically trade at higher discounts on EV/production and EV/reserves operating multiples versus international peers, mostly due to their higher R/P ratios and differences in tax systems.

Until 2011 this company was the most profitable company in the world, dropping to third place for the last two years. Total 2013 net income of approximately $37.5 billion puts this company only behind ExxonMobil (XOM) and Apple (AAPL) in terms of all-out profitability. It is the biggest company in Russia and one of the largest in the world; Open Joint Stock Company Gazprom (OTCPK:OGZPY).

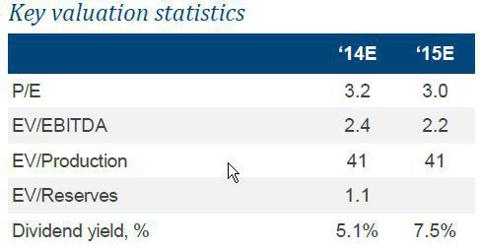

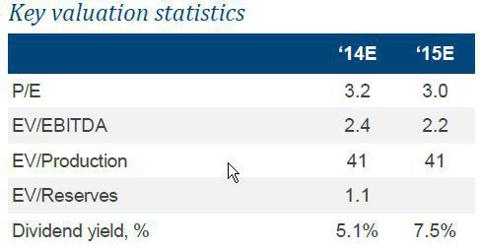

Based in Moscow in the Russian Federation, Gazprom, which was founded in 1993, has quickly become the world's top gas producer. Its major business lines being geological exploration, production, transportation, storage, processing and sales of gas, gas condensate and oil, sales of gas as a vehicle fuel as well as generation and marketing of heat and electric power.

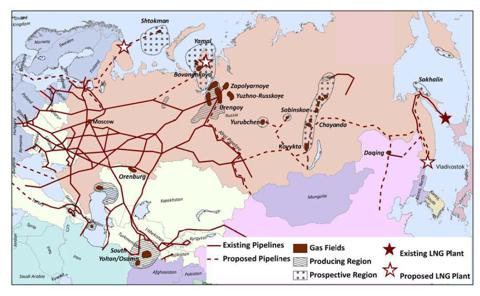

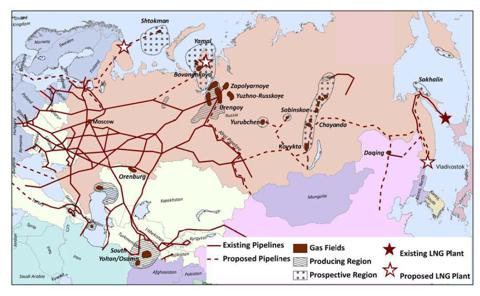

The Company holds the world's largest natural gas reserves, its share in the global and Russian gas reserves accounts for 18% and 72% respectively, and makes up 14% and 74% of the global and Russian gas output. The firm is actively implementing large-scale projects aimed at exploiting gas resources of the Yamal Peninsula, Arctic Shelf, Eastern Siberia and the Far East, as well as exploration and production projects abroad.

(click to enlarge)

OJSC Gazprom Neft (OTCQX:GZPFY) is the oil-producing arm of Gazprom. It's the fourth largest oil producer in Russia and ranked third according to refining throughput. It's a subsidiary of Gazprom, which owns 95.68% of Neft's total common shares. Other affiliated entities of Gazprom can be found here.

Gazprom Neft has been prominently in the news during the last couple of days, with first oil produced in well testing at its Badra oil field in Iraq, with planned commercial production later this year. Recently it started pilot shale oil exploration under its joint venture partnership with Royal Dutch Shell (RDS.A and RDS.B) in Siberia, drilling the first of five pilot horizontal wells this year and next year.

The JV plans multi-stage fractures of all five wells in a bid to tap shale oil potential in the prospective Bazhenov formation, one of the world's largest known shale oil deposits, potentially holding recoverable shale oil resources of 74.6 billion barrels, according to a U.S. EIA estimate. The Russian government has introduced tax breaks to provide incentives for exploration of Bazhenov and other shale plays.

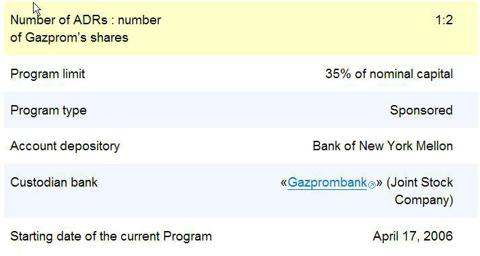

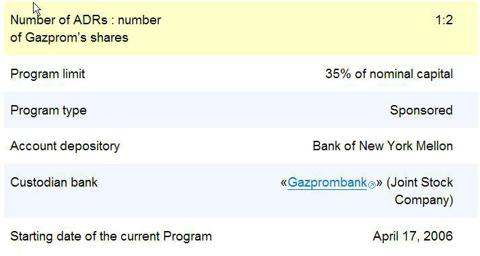

Back to Gazprom, based on the ADR price of $8.20, which is U.S. (OTC) and U.K. (LSE) listed and represents two shares of Gazprom, one share in Gazprom is currently valued around $4.10 or 137 RUB. The ADR's are deposited with The Bank of New York Mellon (BK) and it is possible to convert Gazprom's ordinary shares into ADRs and vice versa.

(click to enlarge)

There are some significant catalysts supporting a retracement of Gazprom's share price, despite big chances on the domestic market, higher taxation, and increased competition on the international front.

A positive export outlook remains as global gas markets remain strong and the outlook is positive. European spot prices are close to Gazprom's LT contract price level. Asia remains the central target of LNG, drawing volumes away from Europe, while the U.S. may see a gas production decline in 2014 for the first time since the shale gas boom began.

The company could sign a contract to supply natural gas to China as soon as the end of this month, after many years of tough negotiations and delays, at least according to CEO Alexei Miller's most recent statement of December 17th. In September, Gazprom and CNPC agreed on the basic terms of an agreement, including volumes, when deliveries should start, payment, etc, but Gazprom failed to secure a price for sales amounting to 38 billion cubic meters (1.3 trillion cubic feet) per year.

The two sides have not disclosed the current size of the gap between Gazprom's offer and CNPC's bid, but in the past it has been at least $50 per thousand cubic meters, a difference of more than $55 billion over time. The international financial media outlets were recently reporting a price range equivalent to $280-$308 per thousand cubic meters at the Russian-Chinese border, but Russian daily, Vedomosti, on Monday reported a higher price range of $360-$400 as a minimum for Gazprom, while also reporting a deal was close. If an impasse remains beyond the Chinese New Year it may take a political decision between Putin and Xi to ultimately seal the deal.

(click to enlarge)

Talking about government intervention, either positive or negative depending on the circumstances, as of December 1st the Russian government ended Gazprom's monopoly on gas export, after a bill was signed that allows other Russian producers to export liquefied natural gas (LNG).

While Gazprom will keep its export monopoly on gas carried through pipelines, the new law will allow other producers like Novatek (OTC:NOVKY) and Rosneft (OTC:RNFTF) to export LNG increasingly as well, in accordance with demand in the international market. Novatek is partnered with CNPC and Total (TOT) in a LNG project in the Arctic Yamal peninsula. Rosneft has plans to build an LNG terminal in Russia's Far East. The only working LNG plant in Russia is located on Sakhalin Island, and is owned by a Gazprom-led consortium including Shell.

The government has also decided it will freeze tariffs on state-regulated services including gas, electricity and railways in 2014, hurting Gazprom's bottom line. The decision is an effort to ease pressure on household budgets and foster growth in Russian economy. Gas and electricity rates, normally raised in July, will not be raised until July 2015, at the level of 2014 inflation. Despite the limitation on tariff growth, current prices do already allow Gazprom to generate profits from the domestic market.

The mineral extraction tax (MET), which is charged on Russian mineral resources including natural gas, gas condensate and crude oil, will rise during the next few years; although the new gas MET formula does provide tax breaks for Gazprom's key gas greenfields, including Yamal, most of East Siberia and the Far East. Transition to the MET formula does add long-term predictability to taxation and links the tax burden to average realized prices. More information on the MET formula can be found here.

On November 12th, 2012, the Russian government approved resolution 2083-R, requiring state-controlled companies to pay at least 25% of International Financial Reporting Standards (IFRS) net income as dividends, and initiatives are already underway to increase dividends to 35% of IFRS net income from 2016. Gazprom's BOD has instructed the management board to get to work on the transition to dividends based on consolidated IFRS results, starting with profit for 2014.

(click to enlarge)

A subsequent increase to 35% of IFRS net income from 2016 onwards may result in Gazprom's dividends more than doubling versus 2013. Gazprom's dividends may well reach 13.7 RUB per share in 2016, yielding an attractive 10% based on current price, certainly amongst the highest levels in the O&G sector.

Gazprom has been rightly criticized for its inefficiency the last several years, the cost of constructing pipelines remains very high, and development of gas fields in East Siberia and the Arctic continental shelf remains a long term goal. All these elements have put pressure on Gazprom. The core of the company's development going forward lies in maintaining the European market while increasing exposure to the Asian market. In the end it also boils down to the powers that be having the determination to further depoliticize and reform Gazprom, as already witness with Rosneft.

The tariff freeze, MET, 25% IFRS dividend rule, and stronger focus on the efficiency of investment projects should incentivize Gazprom to improve its capital discipline and control over operating costs. Higher dividend requirements, as much as 35% of IFRS net income in 2016, may well be an argument in dialog with the government and regulators on taxation of regulated activities, including domestic gas sales and gas transportation services.

Gazprom will have to ensure generation of sufficient cash flow in the medium term, with CapEx as a rule being sufficiently capped. Market-oriented reforms by the Russian government will slowly but surely make Gazprom, and the broader Russian economy, more attractive to foreign investment. In terms of sheer resources the potential is certainly there to be found.

.

Had a big loss on Food Empire... Wasn't attentive enough

1 MTQ

2 Great

Eastern3 Gazprom

4 Jardine CC

5 VICOM

6 Valuetronics

7 Sunningdale

8 ZAGRO

9 LKH

10 Lantrovision

11 Spindex

12 Boustead

YTD up 5%

Gazprom: This Oil And Gas Large-Cap Could Yield 10% By 2016

This article was in Jan. 15, 2014 1:34 PM ET , with GAZPROM trading at above $8, now with the Russian Invasion, its trading at 7.66

Compared to O&G peers on its domestic market, this company trades at a 40% discount on 2015E EV/EBITDA and a 47% discount on 2015E P/E. Compared to international oil majors, this large-cap trades at a 39% discount on 2015E EV/EBITDA, and 2015E P/E shows a 70% discount.

Relative to emerging market peers, this company trades at an average discount on 2015E EV/EBITDA of 44%, and discount on 2015E P/E of 63%. Perhaps its closest EM peer is PetroChina (PTR). Relative to PetroChina, the listed arm of CNPC, we see a 70% discount on 2015E P/E and a 50% discount on 2015E EV/EBITDA.

This large-cap and other DM peers do typically trade at higher discounts on EV/production and EV/reserves operating multiples versus international peers, mostly due to their higher R/P ratios and differences in tax systems.

Until 2011 this company was the most profitable company in the world, dropping to third place for the last two years. Total 2013 net income of approximately $37.5 billion puts this company only behind ExxonMobil (XOM) and Apple (AAPL) in terms of all-out profitability. It is the biggest company in Russia and one of the largest in the world; Open Joint Stock Company Gazprom (OTCPK:OGZPY).

Based in Moscow in the Russian Federation, Gazprom, which was founded in 1993, has quickly become the world's top gas producer. Its major business lines being geological exploration, production, transportation, storage, processing and sales of gas, gas condensate and oil, sales of gas as a vehicle fuel as well as generation and marketing of heat and electric power.

The Company holds the world's largest natural gas reserves, its share in the global and Russian gas reserves accounts for 18% and 72% respectively, and makes up 14% and 74% of the global and Russian gas output. The firm is actively implementing large-scale projects aimed at exploiting gas resources of the Yamal Peninsula, Arctic Shelf, Eastern Siberia and the Far East, as well as exploration and production projects abroad.

(click to enlarge)

OJSC Gazprom Neft (OTCQX:GZPFY) is the oil-producing arm of Gazprom. It's the fourth largest oil producer in Russia and ranked third according to refining throughput. It's a subsidiary of Gazprom, which owns 95.68% of Neft's total common shares. Other affiliated entities of Gazprom can be found here.

Gazprom Neft has been prominently in the news during the last couple of days, with first oil produced in well testing at its Badra oil field in Iraq, with planned commercial production later this year. Recently it started pilot shale oil exploration under its joint venture partnership with Royal Dutch Shell (RDS.A and RDS.B) in Siberia, drilling the first of five pilot horizontal wells this year and next year.

The JV plans multi-stage fractures of all five wells in a bid to tap shale oil potential in the prospective Bazhenov formation, one of the world's largest known shale oil deposits, potentially holding recoverable shale oil resources of 74.6 billion barrels, according to a U.S. EIA estimate. The Russian government has introduced tax breaks to provide incentives for exploration of Bazhenov and other shale plays.

Back to Gazprom, based on the ADR price of $8.20, which is U.S. (OTC) and U.K. (LSE) listed and represents two shares of Gazprom, one share in Gazprom is currently valued around $4.10 or 137 RUB. The ADR's are deposited with The Bank of New York Mellon (BK) and it is possible to convert Gazprom's ordinary shares into ADRs and vice versa.

(click to enlarge)

There are some significant catalysts supporting a retracement of Gazprom's share price, despite big chances on the domestic market, higher taxation, and increased competition on the international front.

A positive export outlook remains as global gas markets remain strong and the outlook is positive. European spot prices are close to Gazprom's LT contract price level. Asia remains the central target of LNG, drawing volumes away from Europe, while the U.S. may see a gas production decline in 2014 for the first time since the shale gas boom began.

The company could sign a contract to supply natural gas to China as soon as the end of this month, after many years of tough negotiations and delays, at least according to CEO Alexei Miller's most recent statement of December 17th. In September, Gazprom and CNPC agreed on the basic terms of an agreement, including volumes, when deliveries should start, payment, etc, but Gazprom failed to secure a price for sales amounting to 38 billion cubic meters (1.3 trillion cubic feet) per year.

The two sides have not disclosed the current size of the gap between Gazprom's offer and CNPC's bid, but in the past it has been at least $50 per thousand cubic meters, a difference of more than $55 billion over time. The international financial media outlets were recently reporting a price range equivalent to $280-$308 per thousand cubic meters at the Russian-Chinese border, but Russian daily, Vedomosti, on Monday reported a higher price range of $360-$400 as a minimum for Gazprom, while also reporting a deal was close. If an impasse remains beyond the Chinese New Year it may take a political decision between Putin and Xi to ultimately seal the deal.

(click to enlarge)

Talking about government intervention, either positive or negative depending on the circumstances, as of December 1st the Russian government ended Gazprom's monopoly on gas export, after a bill was signed that allows other Russian producers to export liquefied natural gas (LNG).

While Gazprom will keep its export monopoly on gas carried through pipelines, the new law will allow other producers like Novatek (OTC:NOVKY) and Rosneft (OTC:RNFTF) to export LNG increasingly as well, in accordance with demand in the international market. Novatek is partnered with CNPC and Total (TOT) in a LNG project in the Arctic Yamal peninsula. Rosneft has plans to build an LNG terminal in Russia's Far East. The only working LNG plant in Russia is located on Sakhalin Island, and is owned by a Gazprom-led consortium including Shell.

The government has also decided it will freeze tariffs on state-regulated services including gas, electricity and railways in 2014, hurting Gazprom's bottom line. The decision is an effort to ease pressure on household budgets and foster growth in Russian economy. Gas and electricity rates, normally raised in July, will not be raised until July 2015, at the level of 2014 inflation. Despite the limitation on tariff growth, current prices do already allow Gazprom to generate profits from the domestic market.

The mineral extraction tax (MET), which is charged on Russian mineral resources including natural gas, gas condensate and crude oil, will rise during the next few years; although the new gas MET formula does provide tax breaks for Gazprom's key gas greenfields, including Yamal, most of East Siberia and the Far East. Transition to the MET formula does add long-term predictability to taxation and links the tax burden to average realized prices. More information on the MET formula can be found here.

On November 12th, 2012, the Russian government approved resolution 2083-R, requiring state-controlled companies to pay at least 25% of International Financial Reporting Standards (IFRS) net income as dividends, and initiatives are already underway to increase dividends to 35% of IFRS net income from 2016. Gazprom's BOD has instructed the management board to get to work on the transition to dividends based on consolidated IFRS results, starting with profit for 2014.

(click to enlarge)

A subsequent increase to 35% of IFRS net income from 2016 onwards may result in Gazprom's dividends more than doubling versus 2013. Gazprom's dividends may well reach 13.7 RUB per share in 2016, yielding an attractive 10% based on current price, certainly amongst the highest levels in the O&G sector.

Gazprom has been rightly criticized for its inefficiency the last several years, the cost of constructing pipelines remains very high, and development of gas fields in East Siberia and the Arctic continental shelf remains a long term goal. All these elements have put pressure on Gazprom. The core of the company's development going forward lies in maintaining the European market while increasing exposure to the Asian market. In the end it also boils down to the powers that be having the determination to further depoliticize and reform Gazprom, as already witness with Rosneft.

The tariff freeze, MET, 25% IFRS dividend rule, and stronger focus on the efficiency of investment projects should incentivize Gazprom to improve its capital discipline and control over operating costs. Higher dividend requirements, as much as 35% of IFRS net income in 2016, may well be an argument in dialog with the government and regulators on taxation of regulated activities, including domestic gas sales and gas transportation services.

Gazprom will have to ensure generation of sufficient cash flow in the medium term, with CapEx as a rule being sufficiently capped. Market-oriented reforms by the Russian government will slowly but surely make Gazprom, and the broader Russian economy, more attractive to foreign investment. In terms of sheer resources the potential is certainly there to be found.

.

No comments:

Post a Comment